Migrant workers in Malaysia are often excluded from many traditional banks as they cannot meet the basic requirements for a bank account. Sending money home is also problematic for many, with numerous challenges that go beyond language barriers and acclimating to new environments. Additionally many have limited experience using technology to manage their money. An easier and more convenient solution is now at hand.

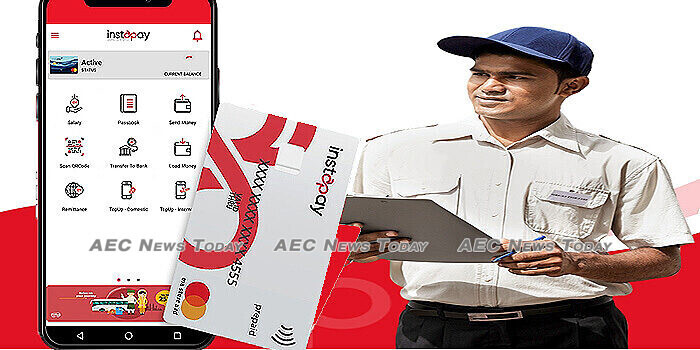

Instapay Technologies Sdn Bhd, a Malaysian fintech initiative has joined hands with Mastercard to offer an e-wallet service targeted specifically at revolutionising financial services for the migrant worker population.

With an Instapay account, employers can pay salaries to their foreign workers digitally, providing better security and efficiency for both the company and the employee. By using the Instapay app, users will have access to the funds in their e-wallet at ATMs with a linked Mastercard card, as well as the ability to make cashless transactions for fund transfers, QR payments, and purchasing mobile reloads.

Cash withdrawals from ATMs using Instapay will cost only MYR1 (about US$0.24), significantly less than the MYR10 often charged for this service, while users will be able to transfer money to their own banks for free.

The Instapay e-wallet also includes a remittance function, enabling migrants to send money to an overseas bank account for cash pick up, or to a local wallet in some countries through a partnership with IME-Ria Money, a licensed remittance and money changer under Bank Negara Malaysia (BNM).

The Instapay app supports nine languages and has been designed keeping the specific needs of foreign migrant workers in mind, with simple yet powerful features.

For increased peace of mind SMS notification are provided for all transactions made via the app or with the Instapay Mastercard, while users can change the card pin, or freeze the physical card, at any time from the app.

The partnership with Mastercard also allows migrant workers to access a range of value added services, with Instapay recently adding insurance to their growing list of products and services.

Hoping to attract some 100,000 users int he first year, Rajnish Kumar, Instapay Technologies co-founder and CEO, said Instapay is “focused on bridging the technology gap” migrant workers face and in providing them with “access to useful and affordable products and services to meet their needs.

“Technology has the ability to dramatically reduce the cost of remittance and at Instapay, we want to make it easier for people to manage their money”.

See her for more information on the Instapay Accounts solution for migrant workers in Malaysia.

Feature photo Instapaytech

Related:

- Covid-19’s push on digital banking (The Borneo post)

- How Will Virtual Banks Shape the Way Malaysians Bank (Fintech)

- Finance: SME Bank wants to be the IJN for SMEs in Malaysia (The Edge Markets)

Justhine De Guzman Uy

After graduation she worked at the Philippine Broadcasting Service performing transcription and business news writing, before moving to Eagle Broadcasting Corporation where she worked as a news editor, translator and production assistant.

Latest posts by Justhine De Guzman Uy (see all)

- Fintech startup to provide greater financial inclusion for Malaysia’s migrant workers – July 25, 2020

- Indonesia morning news for July 24 – July 24, 2020

- Singapore morning news for July 24 – July 24, 2020

- Indonesia morning news for July 23 – July 23, 2020